Life Insurance in and around Pella

Insurance that helps life's moments move on

What are you waiting for?

Would you like to create a personalized life quote?

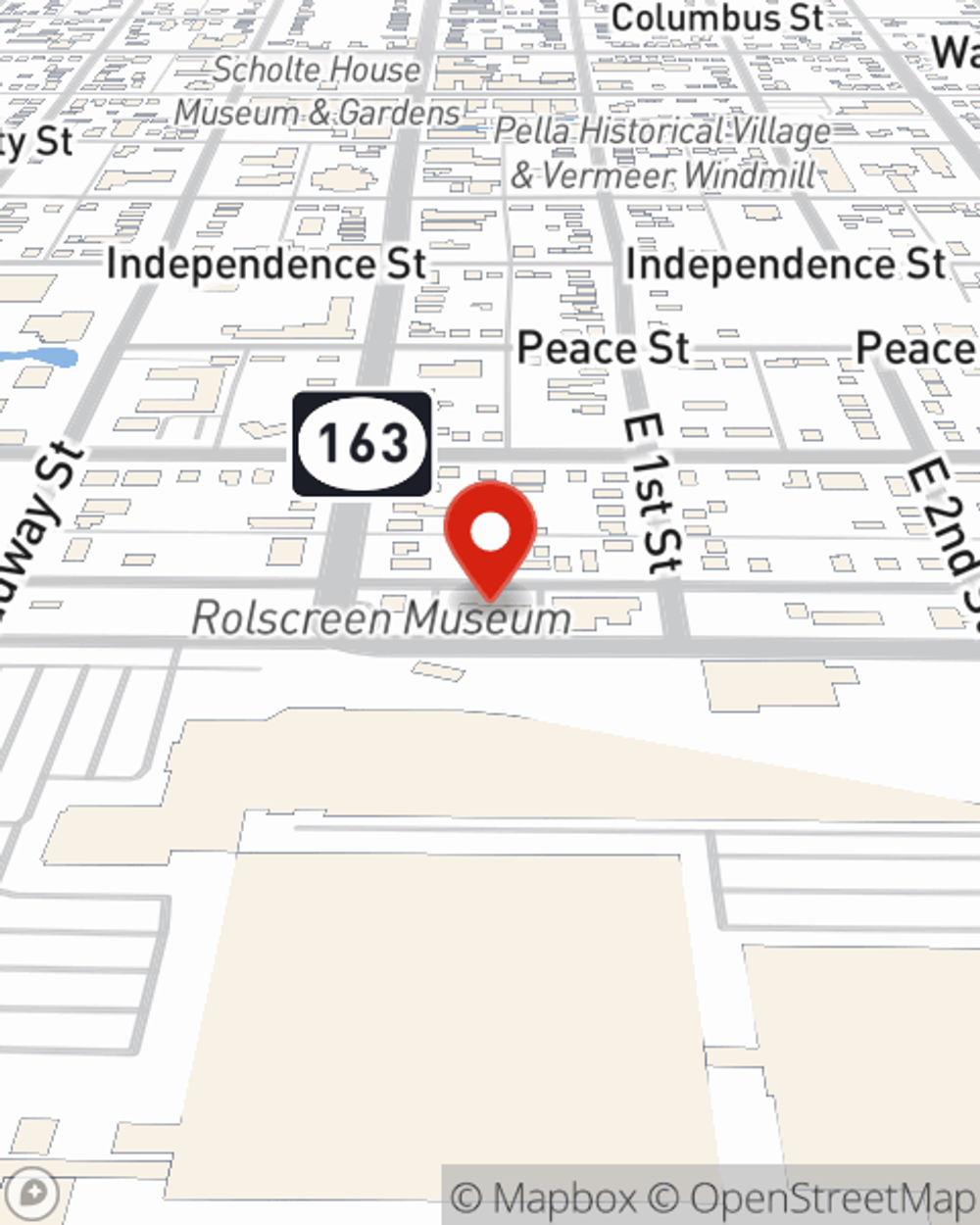

- Pella

- Knoxville

- Oskaloosa

- Otley

- Sully

- Lynnville

- Monroe

- Prairie City

- Leighton

- Pleasantville

- Melcher-Dallas

- Newton

- New Sharon

- Harvey

- Peoria

- Colfax

- Iowa

- Marion County

- Mahaska County

- Jasper County

- Warren County

- Lake Red Rock

It's Never Too Soon For Life Insurance

Buying life insurance coverage can be a lot to ponder with a variety of options out there, but with State Farm, you can be sure to receive caring reliable service. State Farm understands that your goal is to protect the people you're closest to.

Insurance that helps life's moments move on

What are you waiting for?

Why Pella Chooses State Farm

Service like this is what sets State Farm apart from the rest. And it won’t stop once your policy is signed. If the unexpected happens, Kevin Van Wyk is here to help process the death benefit with care and consideration. State Farm has you and your loved ones covered.

To experience what State Farm can do for you, visit Kevin Van Wyk's office today!

Have More Questions About Life Insurance?

Call Kevin at (641) 628-2550 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.

Kevin Van Wyk

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

Enjoy flexible premiums and protection with Universal Life insurance

Enjoy flexible premiums and protection with Universal Life insurance

A universal life insurance policy has flexible premiums, guaranteed returns on cash value, and either a level or variable death benefit.